The Best CRM Software for Banks in 2024: Enhancing Customer Relationships and Streamlining Operations

In the dynamic world of banking, maintaining strong customer relationships is paramount. As banks strive to deliver personalized services, manage customer interactions efficiently, and stay ahead in a competitive market, CRM (Customer Relationship Management) software becomes an essential tool. The right CRM software for banks not only helps in managing customer data but also enhances workflow automation, leads management, and analytical capabilities. Here, Natyz.info explore some of the top CRM software for banks in 2024, detailing their unique features and benefits.

The Best CRM Software for Banks in 2024

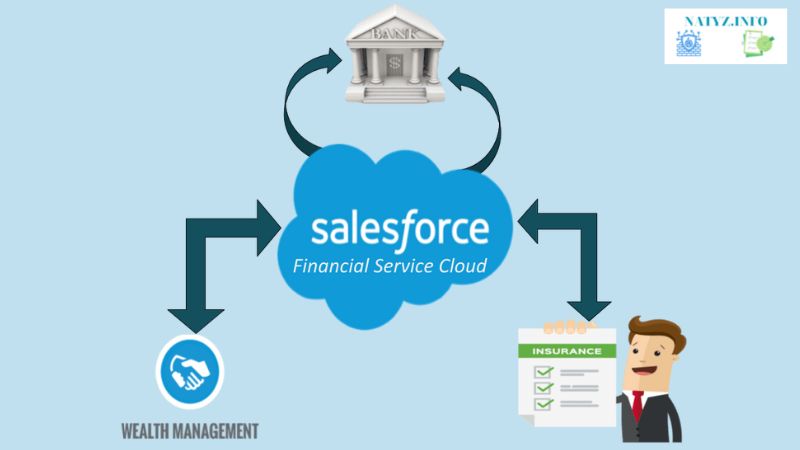

1. Salesforce Financial Services Cloud

Salesforce is a giant in the CRM industry, and its Financial Services Cloud is tailored specifically for the financial sector. This CRM software for banks is designed to manage comprehensive customer relationships and provide a 360-degree view of client interactions.

Key Features:

- Lead and Opportunity Management: Salesforce helps banks track potential leads and manage opportunities efficiently, ensuring that no potential customer is overlooked.

- Advanced Analytics: With robust analytical tools, banks can gain insights into customer behavior, predict trends, and make data-driven decisions.

- Workflow Automation: Automate repetitive tasks, such as data entry and follow-ups, freeing up time for bank employees to focus on more critical tasks.

Suitability: Salesforce Financial Services Cloud is suitable for banks of all sizes, from small teams to large financial institutions, offering various pricing plans from Essentials to Unlimited.

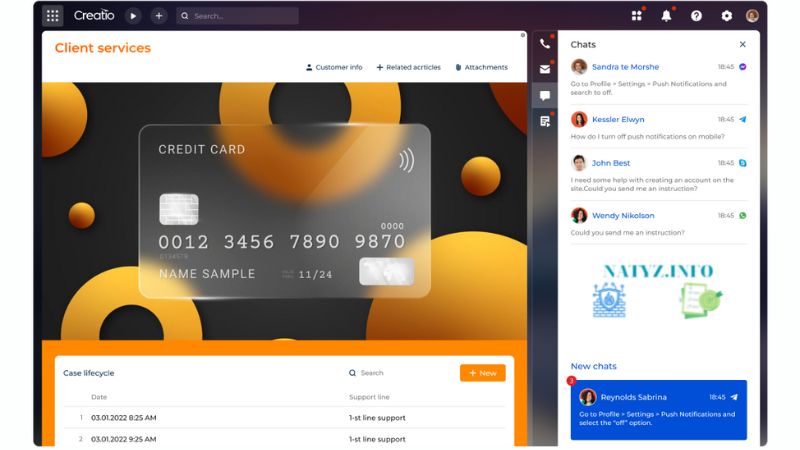

2. Creatio

Creatio is known for its user-friendly interface and powerful customization options. It is an excellent CRM software for banks, particularly small to medium-sized institutions, due to its flexibility and comprehensive feature set.

Key Features:

- 360-Degree Customer View: Creatio provides a complete view of customer interactions, preferences, and history, helping banks deliver personalized services.

- Marketing Automation: The software supports multichannel marketing campaigns, audience segmentation, and in-depth analytics to track campaign performance.

- Workflow Management: Creatio simplifies internal processes with robust workflow management tools, ensuring efficient loan processing and document management.

Benefits: Creatio stands out for its high-level customizations and marketing automation capabilities, making it a favorite among small and medium-sized banks.

3. Microsoft Dynamics 365

Microsoft Dynamics 365 offers a comprehensive CRM solution that integrates seamlessly with other Microsoft products. This CRM software for banks is ideal for large institutions looking for robust customer support and advanced data management.

Key Features:

- Customer Support: Excellent support services help banks manage customer queries and issues efficiently.

- Data Privacy Compliance: The software is compliant with GDPR and other data privacy regulations, ensuring that customer data is handled securely.

- Flexible Customization: Banks can tailor the CRM to meet specific needs, with extensive customization options and configurations.

Drawbacks: While Microsoft Dynamics 365 offers extensive features, it can be expensive and may have a steep learning curve for new users.

4. CRMNEXT

CRMNEXT is a specialized CRM software for banks and credit unions, offering a range of features designed to enhance customer engagement and streamline operations.

Key Features:

- Personalized Offers: Using big data and behavioral analytics, CRMNEXT helps banks create personalized offers for different customer segments.

- Loan Processing: The software provides tools for managing loan applications, including verification, underwriting, and pipeline monitoring.

- Integration Capabilities: CRMNEXT integrates easily with existing bank systems and third-party applications, facilitating seamless operations.

Benefits: CRMNEXT is praised for its easy integration and user-friendly interface, making it an effective tool for improving customer relationships and operational efficiency in banks.

5. Monday.com

Although not exclusively designed for banks, Monday.com is a versatile CRM platform known for its strong workflow automation and task management capabilities. This CRM software for banks offers a flexible solution that can be tailored to fit specific needs.

Key Features:

- Lead Management: Monday.com excels in tracking leads, automating follow-ups, and nurturing potential customers with customizable workflows.

- Reporting and Analytics: The platform provides customizable dashboards and real-time data updates, helping banks track key performance indicators (KPIs) and make informed decisions.

- Workflow Automation: Automate repetitive tasks, such as assigning tasks and sending notifications, to improve efficiency and productivity.

Suitability: With scalable pricing plans and an intuitive interface, Monday.com is suitable for both small community banks and large financial institutions.

Choosing the Right CRM Software for Banks

When selecting CRM software for banks, it’s crucial to consider the specific needs and scale of the institution. Key factors to evaluate include:

- Customization and Flexibility: The ability to tailor the CRM to fit the bank’s unique processes and workflows.

- Integration Capabilities: Seamless integration with existing banking systems and third-party applications.

- User Experience: An intuitive interface and strong customer support to ensure smooth adoption and usage.

- Security and Compliance: Robust security measures and compliance with data privacy regulations to protect customer information.

Conclusion

Investing in the right CRM software for banks can significantly enhance customer relationship management, streamline operations, and improve overall efficiency. Whether it’s the robust capabilities of Salesforce Financial Services Cloud, the customizable workflows of Monday.com, or the specialized features of CRMNEXT, banks have a variety of powerful tools at their disposal. By carefully evaluating the options and considering the specific needs of their institution, banks can choose a CRM that will help them build stronger relationships with their customers and stay competitive in the fast-evolving financial landscape.